5 Reasons Why Property Investors Should Consider Short Term Leasing

Property investment is one of the best ways to build wealth or grow your retirement fund as prices tend to double every 10 years. However, every property investor we’ve talked to always has the same question,

“How do I maximise my investment?”

At MORC, we have been furnishing properties for a variety of clients with different needs, whether for commercial use, long term or short term leasing. If you own an investment property close the city, you’ll be glad to know that there is a way to increase your income.

Short stay rentals are booming across Australia, presenting an opportunity to earn more from your investment property. We have a solid track record of helping our clients get into the short stay rental market and we can safely say that it is a lucrative alternative to traditional renting. In some cases, we saw nearly double the return for our clients when switching to short stay leasing.

You can utilise third party platforms such as Airbnb and Stayz to rent out to tourists, professionals and business travellers. Essentially, you are transforming your humble home to a boutique hotel, commanding a higher rent in the process. This is different from traditional renting, where tenants sign a one-year lease, and usually bring in their own furniture.

In this article, we will list all the reasons you should consider forgoing renting to long-term tenants.

1. You can nearly double your rental income

Firstly, this depends on the location and your target market. Travellers usually prefer to be close to all the attractions, restaurants, amenities and transport. If your property is close to the city, it becomes more viable as a short stay rental.

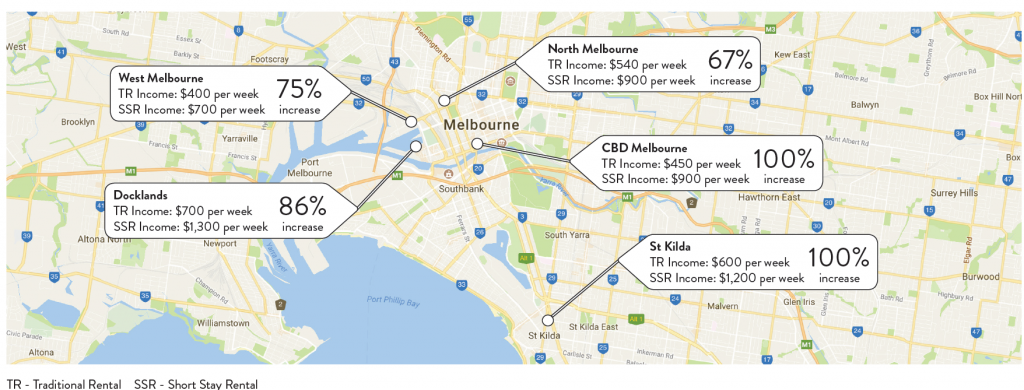

At MORC, the rental income of our clients increased by an average of 80%. That’s a massive upgrade by just switching investment strategies. Based on the map above, you can see that suburbs closer to the city with good transport links and facilities can command good rental rates per week compared to traditional renting. In the CBD and St Kilda, which are hot spots for tourists, our clients have easily doubled their rental income on average.

Higher rental income means you are making a higher rental yield from your investment properties. Even after deducting expenses such as utilities, consumables such as soap and tea bags, fees such as cleaning and third-party charges, our clients are still getting a better rental yield than traditional leasing.

This is because occupancy rates for strategic locations are high, especially during high seasons. Even in low seasons, you won’t see a big drop with around 70%-80% occupancy rate. Melbourne is one of the most visited cities in Australia, attracting foreign and domestic visitors. There are events all year round, which guarantees a steady flow of visitors. Furthermore, tourists are willing to spend a premium on holidays, compared to long-term tenants.

2. Traditional renting is competitive

With traditional renting, you can expect your rental income to increase by 2% to 3% yearly on average. That is a small growth compared to the interest rate rises we are likely to see in the coming years. Furthermore, the market can be crowded and highly competitive with an oversupply of properties closer to the city, especially in Melbourne.

With an oversupply, you may have to settle for bad tenants or a lower rent to meet your loan repayments. This will significantly downgrade your yield, which makes property investment unattractive. Worse, you may end up spending out of your pocket to hold on to your investment.

Having long term tenants also make it harder to sell your property on a whim. If you need cash quickly, there is usually a grace period when you need to inform your tenants and allow them to move out. Breaking a lease tenure requires careful planning, which isn’t ideal during financial emergencies.

3. You call the shots on your investment strategy

With short stay rentals, you can afford to be demanding. You can determine which type of guests you will allow inside your home based on the target market profile. AirBnB allows landlords to screen their guests prior to a booking confirmation.

Also, you can change your nightly rates as you please. Charge higher rates during high seasons, and give a discount during low seasons to ensure your property is occupied.

You can set house rules to protect your property. On the rare occasions when you get unruly guests, you know they will leave after their short stay. With traditional renting, it is difficult to evict a bad tenant especially if their lease tenure isn’t ending anytime soon.

4. Overseas investors still have a place to call home

For foreign investors, they can block out periods for their own stay to save on hotel charges. This is convenient for those who have children or relatives in Australia and visit often. It’s also suitable for those who travel to Australia frequently for business. You’ll get to stay in a fully furnished property rather than a small hotel room.

5. Short stay renting is not as much work as you think

Just like long-term renting, you can get property managers to take care of your property. Most of our clients hire cleaners to clean their spaces between guests checking in and out. There are plenty of service providers for this. You may have to spend time selecting the right one, but it will be worth it in the long run.

Recent Posts

- Coastal Living Made Simple: Inside a Mt Martha Home Styled With Intention

- Bought at 380 Melbourne? Here’s How This Buyer Got a Fully Furnished, Move-in Ready Apartment in Just 7 Days

- Starting Afresh: Furnishing a Newly Renovated Home

- 5 Essential Tips for Home Office Comfort and Productivity

- Episode 2: Home Office Makeover